Another Fraudulent Venezuelan Bond

Lets first deal with the face of the bond.

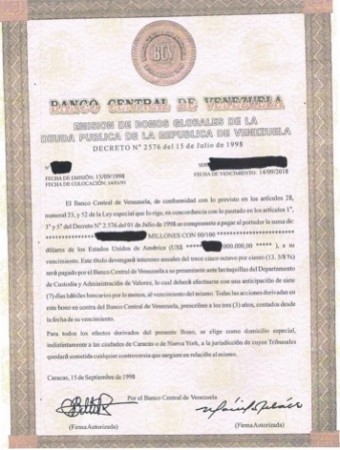

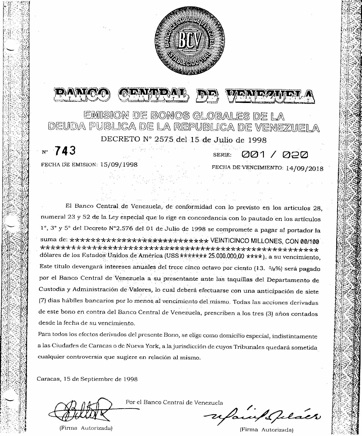

Look at the text where language specific character sets are used, such as the á and é in América, devengará, deberá, and elsewhere throughout the text. These characters have been “aliased” from a Unicode typeface inconsistent with the author’s native language. The system resources are so lacking that the aliased characters are from an entirely different font family.

Second, the bond is printed on an 8.5 x 11 inch sheet of paper (U.S. stationery size), where all exchange bonds — if printed in physical form –are on oversized sheets. While we never had an opportunity to feel or see the paper, it appears to be a security paper of the type used for High School award certificates.

The bonds are silent on the issue of transfer agent, thus the registry of the bonds reverts to the issuer. International convention, promulgated by the BIS, requires that all issuances of marketable sovereign debt have an independent agent for the registry of the bonds. This “bond” does not.

The terms set forth on the face of the bond are very similar to a bond that was issued by the Republic of Venezuela (n.k.a. The Bolivarian Republic of Venezuela) on August 6th 1998, and maturing August 15, 2018. That issuance was underwritten by JP Morgan, Credit Suisse, and ABN Amro. Banco Central is NOT the obligor of these bonds. Those global “Brady Bonds” are a general obligation of the Venezuelan Government. Further, those bonds were NOT issued in physical form, they are held in the clearing system without individual certificates. Those bonds are in an electronic form only – only the terms are similar. Copy of Prospectus – Venezuela-1998-Bonds

The main purpose of Banco Central is to control inflation and maintain the stability of the Bolivar. Under the 1999 Constitution, Banco Central is prohibited from underwriting, cosigning or guaranteeing any debt of the Republic (emphasis added). Further, any bonds allowed to be sold by the Banco Central De Venezuela are dominated in Bolivars, the domestic currency, not in dollars.

But, as they say on TV – Wait, there’s more. It seems that the progenitor of this bond, the bond that the bond in question was copied from – was itself was a fraudulent bond.

The original fake first appeared in Coral Gables Florida in 2003. The Banco De Central Bonds were issued as bearer bonds in amounts of $25,000,000 and were to be sold as bearer bonds by a firm called Capital Investment Services, Inc. Bearer bonds are not sold by governments and would not be eligible for sale to U.S. residents — but they are in circulation. Several have been presented for redemption and or sale in the past few years.

According to a story in Bloomberg, Robert Escobio of Capital Investment Securities said he met with officials at the bank (Banco Central De Venezuela) in Caracas who wanted to sell some bonds. The original fraudulent bonds were 15-year notes with US$25,000,000 printed in red ink on top along with the Banco Central de Venezuela seal in black ink. The counterfeit of the fraudulent bond has the seal printed in red ink. None of these bonds were sold. None.

The offering said that the central bank was to sell $185 million of securities that were part of a $500 million offering authorized in 1998 by former Venezuelan President Rafael Caldera. According to Bloomberg data, Venezuela sold all $500 million of those 13-5/8 percent bonds in 1998 through the Venezuelan Finance Ministry.

It was a good scam – almost. These fraudulent bonds were even listed on Bloomberg for a short period. The bonds raised such an uproar that even the Venezuelan legislature got involved in the investigation of who was responsible for the request to sell them.

Now here is where this gets more interesting. There’s more. I’m serious.

The image of the bond this story started with, the counterfeit fraudulent bond, has the same language and the exact same signatures as the fraudulent bond. It is composed in a different style, and the text wraps differently than the original fraud – but they are otherwise the same. In this case, unlike in math, the product of two negatives does not result in a positive. It’s like copying the test answers off of the dumbest guy in class.

Venezuela is a sketchy country at best, and with the departure of Rafael Caldera and the election of Hugo Chavez, it has become sketchier. Not a month goes buy that I don’t get a call about this, that, or another scam emanating out of Venezuela — bonds, oil and gas, whatever. There has been speculation in some circles that the original fraudulent BCV bonds were used as a ruse to raise money by a few people in-the-know who were looking to leave Venezuela with the proceeds of the fraud while derailing other rounds of financing that had been proposed in 2003 shortly before the fraudulent bonds first surfaced.

There is an argument that you cannot make a counterfeit of a fraudulent original because the definition of counterfeit “…made in exact imitation of something valuable or important with the intention to deceive or defraud…” cannot apply. I disagree. Good art is good art – even if the artist did use a photograph for reference. This, on the other hand, was not good art. I believe that argument “that you cannot make a counterfeit of a fraudulent original” is a discussion for logicians or philosophers, not a defense.

Note some language from the bond: Banco Central de Venezuela, Emision De Bonos Globales De La Deuda Publica De Republica de Venezuela. Decreton N° 2576 del 15 Julio de 1998: Fecha de Emision: 15/09/1998, Fecha De Colocacion: 14/01/91, Fecha de Vencimiento 14/09/2018 13. 5/8%