Free Lunch

David Cay Johnston

Portfolio ISBN: 1-978-1-59184-191-3 352 pages $24.95

https://www.penguinrandomhouse.com/books/300246/free-lunch-by-david-cay-johnston/

The editors of AEGIS journal are died in the wool free-market capitalists, and believers in the minimal amount of government intervention. We do not, however, believe in thievery or a disconnect of economics from the public good. Nor do we believe in the legitimacy of extortion, intimidation, or government corruption as tools of private enterprise. Nor do we believe that all industries can be free of regulation, or price regulation (power generation springs to mind), nor even that all industry can be run as for-profit enterprise (health care, for example, where health care is turned to profit by refusing health care). Free Lunch deals with all these areas.

Many people who ostensibly base their economic views on Adam Smith – we suspect that some of them ascribe to but have never actually read An Inquiry into the Nature and Causes of the Wealth of Nations – seem to have forgotten Smith’s warnings that unchecked self-interest, especially when aided by the government, will spoil the benefits of capitalism. He said, “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.” Smith notes, “But though the law cannot hinder people of the same trade from sometimes assembling together, it ought to do nothing to facilitate such assemblies, much less to render them necessary.” This ignored dictum, reflected in the 35,000 paid lobbyists infesting Congress, figures heavily inJohnston’s view of the causes of many of today’s economic problems.

If we ask ourselves, today, the question that Reagan asked in 1980 (Are you better off now than you were four years ago?) how could the answer be anything but yes? After all, our economy has more than doubled since 1980, and income increased by 79 percent between 1980 and 2005, while the population increased by only a third, which means there was more money for everyone. So how could we not be better off?

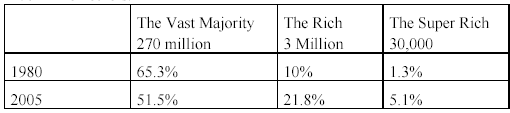

The answer, of course, depends on who “we” is. In 2005 the top one-tenth of one percent of households – some 300 thousand men, women, and children made more than the 150 million who make up the bottom half. In 1980 the bottom 90 percent of the population shared roughly two-thirds of the income, while by 2005 they shared roughly half.

This can be more easily seen in a chart comparing the change in income distribution forAmerica’s 30 thousand really rich, the 3 million rich, and the 270 million others.

But didn’t the majority of Americans still see a growth in income as a result of the efforts of the rich and the superrich? No. Income for the bottom 90 percent of Americans actually dropped relative to inflation, and they had less money to spend each week. The result is a country whose income distribution matches that of third-world nations like Brazil and Russia.

This change in income distribution is the result of government policy choices. Since the 1980s, we have moved from the 1930s policy of strengthening the middle class to strengthening the well-lobbied wealthy.

There were three reactions to this book, largely related to the readers’ position on the political spectrum. On one side, you had readers horrified by what was happening. On the other, side we had readers who considered the book an invaluable how-to on using the government for enrichment if you are fortunate enough to have money for, er, lobbying.

In the middle, we had a philosophical view that this was really caused by failing industries trying to cling to the status quo as long as they can and invent exasperating theories for why competing technologies should be throttled. They believed that this book is a public treatise on how dying companies are supported by the government though regulating other companies out of business, and how large companies use all of their political will, muscle, and check books to exchange even more favors for more money. It is chapter and verse about how a government can be perverted by business for business’s needs and against the public interest (read Tyranny of the Status Quo by Milton Friedman).

There were several categories of problem areas discussed, of which we will mention only a sampling. One is not-for-profit companies that convert to for-profit companies to the detriment of their client base. As an example, one of the complaints commonly heard is that health care in theUnited Statesis too expensive. Partly this is because of successful lobbying to write legislation to prevent bargaining by Medicare for best-prices from drug companies. But the author argues further that money spent for health care by not-for-profit organizations is lost when the companies become for-profit organizations. Profits, after all, come from refusing to pay for treatment (some have said that 45% of for-profit heath care dollars are spent on administration – saying no – not healthcare.), with the money saved being either given to shareholders or senior managers. How much do healthcare managers get? To pick one example at random, UnitedHealth Group (the company we use), which spent $ 1.1 million lobbying in the first quarter of this year, showed in its annual report that the top five officers took home $33,816,637. In addition, dividends of $36,000,000 were paid. Had this been a not-for-profit organization there would have been an additional $60 million plus available for healthcare.

Another category is industries that the author feels should be regulated, but are not. An example would be power generation, which used to allow a profit of ten percent. With de-regulation, a gift of the efforts of Enron, prices have escalated. One study indicated that states adopting Enron-style deregulation paid $48 billion more than they would with traditional regulation, which ties price to the cost of production. Since power generation is not a competitive market (it is a sellers’ market), this is in line with computer simulations of the price of electricity with no collusion on the part of generators. Partly this is caused by the fact that electricity, which is auctioned off in fifteen minute segments, pays everyone on the net the highest rate accepted anywhere in the system. Thus, if you have a nuclear power plant with electricity it will give away, and some small plant that sells a few megawatts of power at $990, everybody gets $990. In addition, many power companies are owned by the came corporation, so that what appears to be a vibrant market is not. Finally, unregulated power companies can be sold for a song (construction cost less depreciation), bonds issued for the actual value, and the difference passed on to the consumer. Plus, of course, when the plant is re-sold to a sister company, those costs will be added to the cost the consumer bears. Plus, of course, while consumers pay taxes to the power generator, the parent company not-infrequently does not pass them on to the government. According to the author, Warren Buffett, who invests in utilities, fights against paying these collected taxes.

Oddly, when municipalities have their own power generation systems, its citizens pay significantly lower power costs. According to the author, Buffett has worked hard, with the cooperation of government officials, to make sure that electricity prices would not fall.

This leads us naturally to a third area that the author feels is bad: Government regulations that either give money directly to a company or allow it to pass on costs. As an example cited by the author, when Amtrak started, legislation made them liable for all accidents involving Amtrak trains. According to the author, the natural conclusion for owners of the tracks (Amtrak merely leases them to run on) is that there is no need to do regular maintenance. By cutting maintenance, CSX saved billions of dollars that would have otherwise gone to maintenance. What this means to those of us who travel is that maintenance-regulation-heavy plane crashes kill 1.9 folks per 100 million miles traveled, big trucks (also well regulated) kill about 2.5 people per 100 million miles traveled, and trains kill 130 people per hundred million miles traveled. Since inspectors are so under-funded, few accidents are investigated. In one case, where the author says a judge ruled that the proximate cause of a death was CSX’ reckless disregard for human life, the punitive damages against CSX were passed to Amtrak to be paid by the taxpayers.

There are other ways to get the taxpayer to cough up money. For example, a company might convince a municipality – or even a state – to give it benefits. The author notes that in its 2007 annual report to shareholders, Cabela’s said, “Historically, we have been able to negotiate economic development arrangements relating to the construction of a number of our new destination retail stores, including free land, monetary grants and the recapture of incremental sales, property or other taxes through economic development bonds, with many local and state governments.” This means that if you want to open a store, sell merchandise, and collect and pay taxes, you will be hard pressed to compete with a company that was given land, given tax breaks, and perhaps allowed to keep the sales taxes it collected.

The benefits given are immensely profitable to the corporations that receive them, but don’t they also bring commensurate benefits to the communities in which these corporations exist. Sadly, no. Picking again on Cabela’s, the author says of a store inWest Virginia, “Thanks to the generosity ofWest Virginia taxpayers, Cabela’s will realize an astonishing $115 million for its skill not in the competitive markets, but in manipulating politicians. … My analysis of its reports suggests that at best Cabela’s earns an annual profit of $12.60 per square foot of retail space. This means it captures about 3.6 cents out of each dollar as profit. At that rate of profit the whopping $115 million gift fromWest Virginia taxpayers roughly equals 52 years of profits from the store there. If the state were to get all of the sales taxes from that store, instead of letting Cabela’s pocket that tax money, it would take more than 31 years to get back the $115 million.

To get an idea of just how generous the gift to Cabela’s was, it is useful to compare it to state spending. The state could provide free lunches for 50 years to all theWest Virginia children who are so poor that they qualify for that form of welfare.”

We won’t go into the many other issues discussed. We also won’t discuss the author’s solution, which includes paying our elected representatives enough that they don’t have to be on the corporate dole, and punishing them for taking anything from lobbyists. The fact that one does not have a complete solution does not mean that one can’t recognize the existence of a problem.

The bottom line is that whether you are in the 90 percent who are not better off than they were 8 years ago or in the top ten percent who are better off, and would like to know how to do even better still at the public trough, this book goes on our must read list. As is often the case, it makes it to the list not because the editors necessarily agree completely with the description of the problem or the solutions offered, but because it addresses a serious problem that clearly demands wider public debate. This adds it to the must read list that now includes:

• All You Need Is Love, and Other Lies about Marriage by John W. Jacobs, M.D

• Better by Atul Gawande, M.D.

• Beyond Fear by Bruce Schneier

• Corpocracy by Robert A. G. Monks

• The End ofAmerica, by Naomi Wolf

• How Doctors Think by Jerome Groopman, MD

• Inside the Tornado by Geoffrey A. Moore

• Rediscover Your Native Fitness (PACE), by Al Sears, M.D.

• Reinventing the CFO by Jeremy Hope

• Taking Sex Differences Seriously by Steven E. Rhoads

• What Clients Love by Harry Beckwith

• With Winning in Mind by Lanny Bassham