Bogus Venezuelan Bonds

This is an excerpt of a report on some very bogus Venezuelan Bonds circulating around the fringes of the financial community. I am not joking when I tell you I have had no less than five calls regarding these bonds — so I know they are making the rounds.

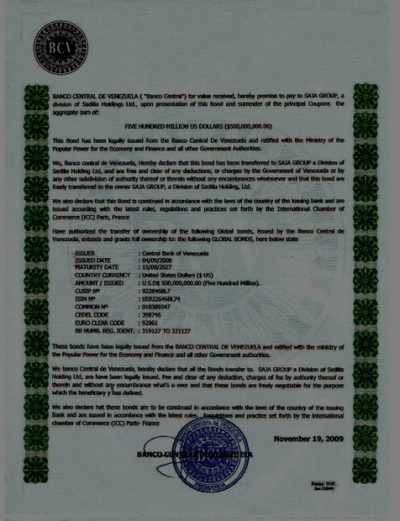

The Bond, as issued, is an obligation of the Central Bank of Venezuela – aka, Banco Central de Venezuela

This is a convincing document at first blush, but it has several flaws. Banco Central, wholly owned by the Republic of Venezuela, is Venezuela’s central bank and currency-issuing bank. The Constitution enacted in 1999 granted Banco Central, for the first time in Venezuela’s history, constitutional authority as an independent legal entity with autonomy to exercise its delineated powers.

From the face of the bogus bond

Issue Date: 04/09/2008

Maturity Date: 15/08/2027

Currency: US Dollar

Amount of Bond: 500,000,000

CUSIP: 922646BL7

ISIN: US9226646BL74

Common: 018389347

CEDEL Code: 398746

Euro Clear Code: 92961

The main purpose of Banco Central is to control inflation and maintain the stability of the Bolivar. Under the 1999 Constitution, Banco Central is prohibited from underwriting, cosigning or guaranteeing any debt of the Republic. (Emphasis added).

If such a bond issuance were to have occurred it would be reflected in the notes of the annual audited financial condition of Banco Central, and these bonds are not.

The bonds are silent on the issue of transfer agent, thus the registry of the bonds reverts to the issuer. International convention — promulgated by the BIS, requires that all issuances of marketable sovereign debt have an independent agent for the registry of the bonds. This bond does not.

The next flaw has to do with the CUSIP and ISIN numbers on the bond. These are valid CUSIP and ISIN numbers that do correspond to a debt of the Republic of Venezuela — “global bonds” issued in 2004, not this Banco Central bond with an issue date in 2008.

The global bonds have been accepted for clearance through the DTC, Euroclear and Clearstream, Luxembourg (Common Code: 018389347, ISIN: US922646BL74;

CUSIP No. 922646BL7). To emphasize, these are for the Republic of Venezuela Global Bonds – not bonds issued by Banco Central, and not the bonds that are the subject of this article.

The form of the bond is wholly inconsistent with any physical bond that would be traded on an exchange. The document is imaged by a computer printer, the type face used is incongruent with the size and font used on publicly traded bonds, there are a few miss-spellings, and no bond issued by the central bank of a sovereign nation is going to relinquish jurisdiction to the ICC rules in Paris, France

As for the images in the document, there is a long history of documents similar to this that have been scanned, cleaned and altered using image software such as GIMP or Photoshop, and then reprinted. When you look closely at the document you can see that it was printed on a Classic Laid paper in at least one generation – as the distinctive laid pattern is in the image behind most of the text. However, the scan was hastily cleaned, exposing the altered areas where the pattern is absent in the background.

Bonds that conform to minimum standards for acceptance in exchange trading are printed by an intaglio process on oversized acid free

There are dollar denominated notes issued by the Central Bank of Venezuela, but theses are issued against deposits of Bolivars, or other assets held by the bank. These notes are issued as a way to avoid Venezuelan currency exchange controls. These “exchange control notes” are much smaller in domination, shorter term and, since they are issued against deposits, are not a “debt” of Banco Central (thus avoiding Banco Central’s constitutional prohibition of accruing debt on behalf of the Republic).

If this were on of the exchange control note, it would be in Spanish and English, several pages long, and not make reference to an exchange traded fully registered debt issuance of the Republic of Venezuela.

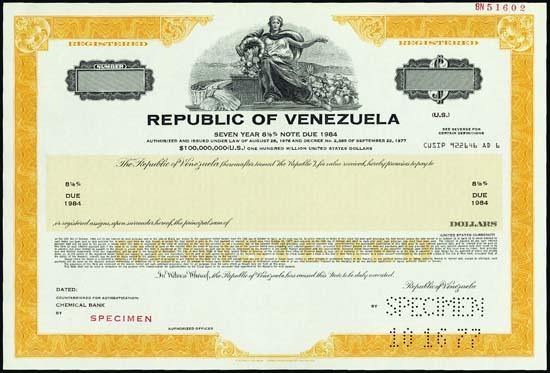

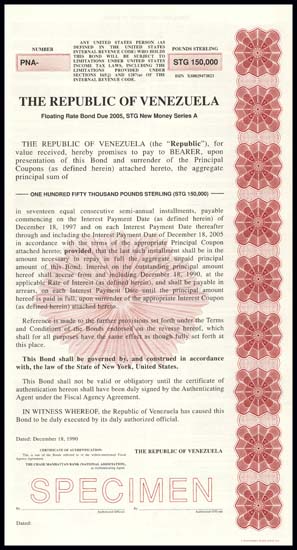

Please see the following images of bond certificates for paper exchange traded debt Republic of Venezuela.

The bond on the left is from a debt issuance in 1984, and the bond on the right was from a debt issuance in 2005. While the style is different, one can clearly see the tremendous difference in quality and style of the documents, the design and the spelling. The document quality standards, and the third party transfer agent requirement, are efforts to prevent counterfeiting of the bonds and to thwart any temptation the issuer may have to issue unauthorized bonds to an unsuspecting public.

The documents accompanying the bogus bond, purporting to prove provenance and ownership, were concoctions of the lowest order, riddled with spelling errors and Spanglish. It was evident that the creator of the foundation documents could not copy a CUSIP number correctly, or spell in any language they attempted here.

Nuff said?