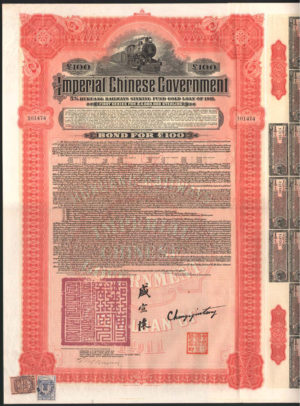

China’s Legacy Bonds

I have been fascinated over the past several years by traffic in Post 1911 Chinese Bonds. Not the numismatic traffic — but the traffic creating fiscal terror perpetrated by people who claim these Chinese legacy bonds are valid obligations and that the Chinese Government is going to pay.

When China’s 2,000 plus years of monarchical rule was overthrown in 1911, The Republic of China was born. During the period between 1911 and 1949, the new Republic’s efforts to gain economic traction were hobbled by two world wars and Japanese colonial ambitions. After expelling both the Japanese and the criminal running the Chinese government, the communists arrived…

In theory, as the Communists gained control of the mainland, the Republic of China relocated (and exists to this day) on the island of Taiwan. In theory.

During this transitional period, from 1911 to 1949, hundreds of millions of dollars in bonds were sold to Western investors betting on China’s future.

These bonds issuances were;

1911 5% Hukuang Railways

1912 5% Crisp Gold Loan 1912

1913 5% Lung-Tsing-U-Hai Railway

1913 5% Reorganisation Loan

1914 5% French Industrial Gold Loan

1918 8% Marconi Loan

1919 8% Vickers loan

1919 6% 2-Year Gold Loan Treasury Notes

1920 8% Lung-Tsing-U-Hai Railway Loan

1921 8% Lung-Tsing-U-Hai Railway Loan

1922 8% Railway Equipment Loan

1923 8% Lung Tsing U Hai Railway Loan

1925 5% (French Boxer Indemnity) Rep US Gold

1925 8% Lung-Tsing-U-Hai Railway Loan

1925 8% Skoda Loan II

1934 6% British Boxer Indemnity

1936 6% Shanghai Hangchow Ningpo Railway Completion Loan

1937 4% Liberty Bond

1938 5% 27th Year Gold Loan

1940 5% 29th Year Gold Loan

These massive bond offerings, widely acquired by governments, banks, and investors across the globe, funded the modernization of China’s infrastructure. Who were the underwriters of these bonds? J.P. Morgan, HSBC, Deutsche Bank, Kuhn Loeb & Co., the First National Bank of the City of New York, and the National City Bank of New York — you know, the usual suspects.

While the bonds represented a binding engagement upon the government of The Republic of China, and its successors, China defaulted in 1938 and left millions of global creditors unpaid even to this day. According to the terms of the bonds, the holders can hold modern day China accountable for these obligations — but any help the bondholder might expect from their respective government has been on hold since 1938.

The Chinese are experts at interpretative history. Arguing history and facts with the Chinese government is like playing cards with a five year old — the facts change as it suits their interest. To the Chinese, history is malleable, and historical narrative is as much a product of current political considerations as it is a chronicle of past events.

As an heir to the recently celebrated 1911 revolution, why did the Chinese government choose to avoid paying their international debt? In short, the mainland of China states that The Republic of China is on Taiwan — and the debt is theirs (despite proclamations that there is only one China). Contradicting this position is the historical record — which indicates that all of the borrowing, banking, and investments were on Mainland China. In any case, virtually none of the bonds have been paid. I believe this may have been the origin of the phrase “a giant sucking sound,” but don’t quote me on that. In acknowledgement of the debt, a few of these bonds held in the UK were paid (pennies on the dollar) during the 1980 negotiations on the return of Hong Kong.

Mainland China recently celebrated 100 years of history since 1911, and the current government claims to be heir to the revolution. Yet, mysteriously, there is no acknowledgement of these unpaid debts. By international law these debts cannot be repudiated, they must be litigated on a country-by-country / county-to-country basis (as citizens have no standing to sue a sovereign nation).

Bondholders in the U.S. can petition the US Foreign Bond Holders Protective Council (created by law in 1933 to settle debts from WWI). The State Department sponsored the law creating the Council in the belief that it would facilitate settlements agreeable to both debtors and creditors. It appears to have been a failure upon inception, an analysis supported by the fact it held its last meeting in the 1980’s.

For those intrigued by other bonds games you can’t win – following is an interesting legal position. http://www.globalsecuritieswatch.org/may30_2003_memo.pdf

Unpaid debt by a sovereign government is nothing new – just another chapter in a series of sovereign defaults plaguing investors over the past few hundred years. To those who see this as news, and believe they hold valuable bonds, take it as a warning – many possess only a numismatic value.

It is worth noting that FE&E, Inc. has been hired several times to investigate funds that are buying these bonds and claiming them as assets at face value enhancing the value of that fund. We have seem these bonds proffered as security for loans or as assets backing insurance companies. The fact that these bonds could be collected has prompted several people to claim that these bonds are worth face value as their are viable financial instruments and can be negotiated. In reality, they represent beautiful artwork and a lesson in history.

Please check out the links in this article if you are looking to purchase these bonds for numismatic value. Please call us if you are looking to purchase them as an investment (Now that’s full disclosure)!

Much thanks to the folks at www.HistoricalBonds.com for images and information.